If you want to know how to apply for pan card in India then you are at the right website. I will guide you in this tutorial so that you can easily apply for the pan card easily.

What is PAN Card?

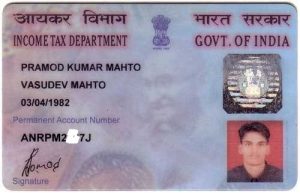

A permanent account number (PAN) is a ten-character alphanumeric identifier, issued in the form of a laminated “PAN card”, by the Indian Income Tax Department, to any “person” who applies for it or to whom the department allots the number without an application.

A PAN is necessary for filing income tax returns. PAN is an electronic system through which, all tax related information for a person/company is recorded against a single PAN number. This acts as the primary key for storage of information and is shared across the country. Hence no two tax paying entities can have the same PAN.

Structure of Pan

The PAN (or PAN number) is a ten-character long alpha-numeric unique identifier. The PAN’ structure is as follows: Fourth character [P — Individual or Person ] Example: AAAPZ1234C

- The first five characters are letters (in uppercase by default), followed by four numerals, and the last (tenth) character is a letter.

- The first three characters of the code are three letters forming a sequence of alphabets letters from AAA to ZZZ.

- The fourth character identifies the type of holder of the card. Each holder type is uniquely defined by a letter from the list below:

A — Association of persons (AOP)

B — Body of individuals (BOI)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Individual or Person

T — Trust (AOP)

• The fifth character of the PAN is the first character of either:

– of the surname or last name of the person, in the case of a “personal” PAN card, where the fourth character is “P” or

– of the name of the entity, trust, society, or organisation in the case of a company/HUF /firm/AOP/trust/BOI/local authority/artificial judicial person/government, where the fourth character is “C”, “H”, “F”, “A”, “T”, “B”, “L”, “J”, “G”.

• The last (tenth) character is an alphabetic digit used as a check-sum to verify the validity of that current code.

• Remaining Letters – remaining characters are random. The first 4 characters are numbers while the last one is an alphabet.

• Signature of the individual – PAN Card also acts as a proof of the individual’s signature required for financial transactions.

• Photograph of the individual – PAN acts as a photo identity proof of the individual. In case of companies and firms, no photograph is present on the card.

Eligibility of Pan

PAN Card is issued to individuals, companies, non-resident Indians or anyone who pays taxes in India.

Documents for Pan

PAN requires two types of documents. Proof of address (POA) and Proof of Identity (POI). Any two of the following documents should meet the criteria:

| Individual Applicant | POI/ POA- Aadhaar, Passport, Voter ID, Driving Licence |

| Hindu Undivided Family | Hindu Undivided Family An affidavit of the HUF issued by the head of HUF along with POI/POA details |

| Company registered in India | Certificate of Registration issued by Registrar of Companies |

| Firms/ Partnership (LLP) | Certificate of Registration issued by the Registrar of Firms/ Limited Liability Partnerships and Partnership Deed |

| Society | Certificate of Registration Number from Registrar of Co-operative Society or Charity Commissioner |

| Foreigners | Passport PIO/ OCI card issued by the Indian Government Bank statement of the residential country Copy of NRE bank statement in India |

| Trust | Trust Copy of Trust Deed or a copy of the Certificate of Registration Number issued by a Charity Commissioner. |

How to apply for PAN Card in India

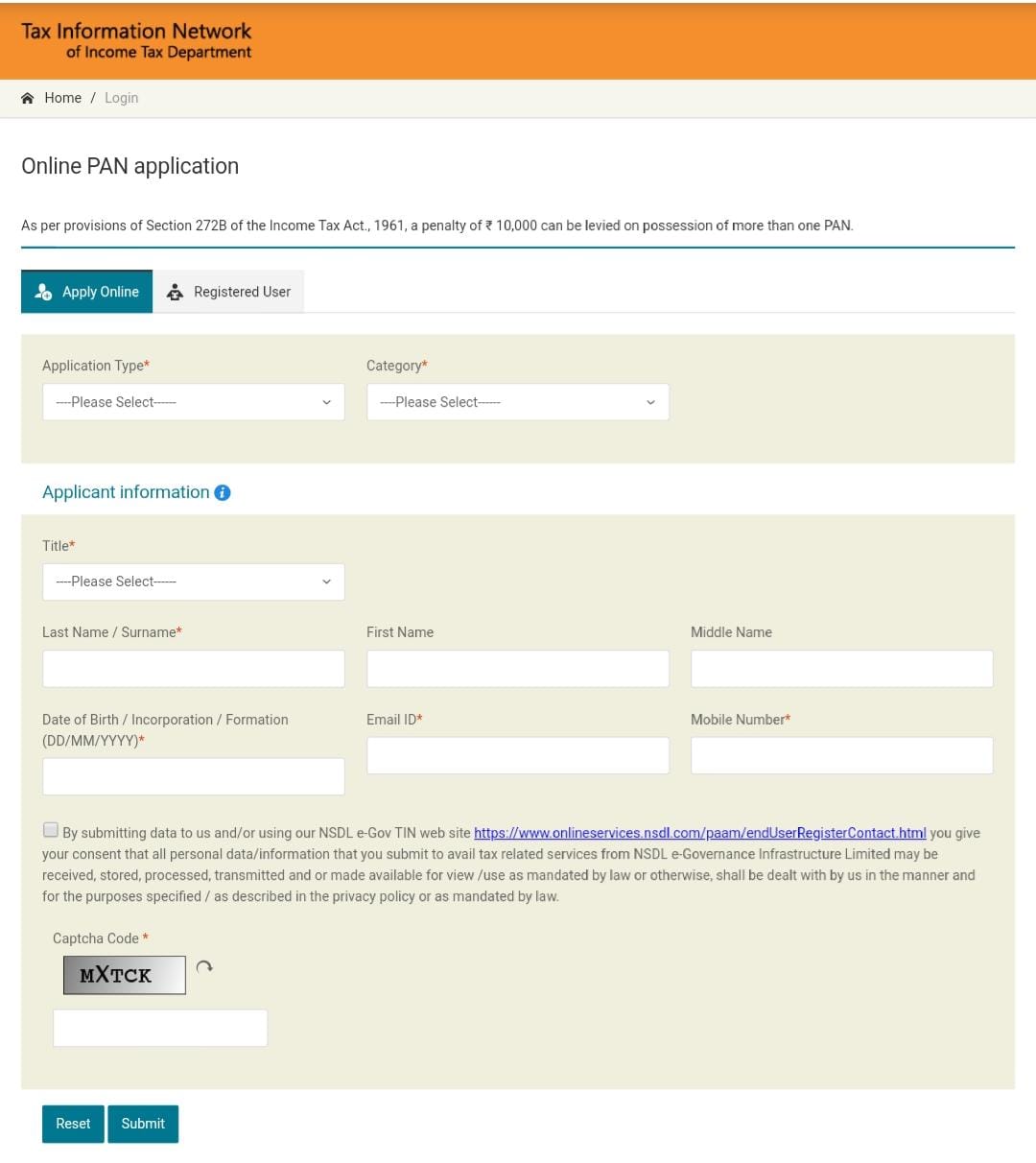

Step 1: Go to the official website of NSDL i.e. www.onlineservices.nsdl.com.

Step 2: A page will open, under Application Type select New Pan- Indian Citizen (Form 49A). If you are a foreign national then select New PAN -Foreign Citizen(49AA)

Step 3: Select the category of PAN card you need. After filling the first step you will get the token number. This token no can be used for further filling the form.

Step 4: Fill in your personal details like name, date of birth, mobile number, etc

Step 5: Enter the captcha code and click submit

Step 6: After clicking the submit button, a token number will be generated. This token no can be used for further filling the form. You will be required to click on the link to continue with your PAN application

Step 7: A new page will appear and it will show you three options: 1. Submit digitally through e-KYC and e- Sign (paperless) 2. Submit scanned image through e-Sign 3. Forward application documents physically.

Step 8: The most common and preferred is scanned image through e-sign.

Step 9: After selecting the option, enter your details such as Adhaar Card number, parents name, etc. click next.

Step 10: This step requires you to fill in your name, date of birth, address etc. After filling all the details click Next.

Step 11: In the next step, you will be required to enter your area code, AO (assessing officer) type, range code, and AO number. Click next.

Step 12: Select the documents you have submitted as proof of age and residence from the drop-down menu, fill in the required detail and then click submit.

Once your documents are uploaded you will be directed to the payment page, you can choose one of the many online payment methods. The fee for PAN card application is ₹ 109 excluding additional bank charges, if any. If you have chosen to send the physical documents instead of opting for e-KYC or e-Sign, then you will have to make a payment of ₹ 72.

That’s good . I think you should also add screenshot of each steps. 😅

Don’t worry bro. I’ll update it very soon and will add screenshot for each steps.

GOOD INFORMATION ….BENEFICIAL FOR PUBLIC….

Thank you soo much Saurav

शानदार जबरदस्त जिंदाबाद